Download 2016 Honda Xr400 Manual torrent. Mindray Datascope AS-3000 Service manual 3.5 MB Download prohibited by Mindray. Mindray Wato EX-65 Service. Service manual 7.1 MB Download Ulco. The Anestar S is ideal for Outpatient Surgery Centers or OR-s with space constraints as it offers a small footprint, ergonomic design and high quality durable. Get the best deal for DataScope Patient Monitors from the largest online selection at eBay.com. Browse our daily deals for even more savings! Free shipping on many items! Foreword Introduction Foreword This manual is intended to provide information required to properly service the Datascope CS300 Intra-Aortic Balloon Pump. Warnings, Precautions and Notes Please read and adhere to the following list of warnings, precautions and notes; some of which are repeated in the appropriate areas throughout this manual.

- Datascope Anestar Service Manuals

- Datascope Anestar Plus Service Manual

- Datascope Anestar Service Manual User

- Datascope Anestar Service Manual Transmission

- Datascope Anestar Service Manual Pdf

PART I

This Report on Form 10-K contains statements that constitute 'forward- looking statements' within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which generally can be identified by the use of forward-looking terminology such as 'may,' 'will,' 'expect,' 'estimate,' 'anticipate,' 'believe,' 'target,' 'plan,' 'project' or 'continue' or the negatives thereof or other variations thereon or similar terminology. These statements appear in a number of places in this Report on Form 10-K and include statements regarding our intent, belief or current expectations that relate to, among other things, trends affecting our financial condition or results of operations and our business and strategies. We may make additional written or oral forward-looking statements from time to time in filings with the Securities and Exchange Commission or otherwise. Forward-looking statements speak only as of the date the statement is made. Readers are cautioned that these forward-looking statements are not a guarantee of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of many important factors. Many of these important factors cannot be predicted or quantified and are outside of our control, including competitive factors, changes in government regulation and our ability to introduce new products. The accompanying information contained in this Report on Form 10-K, including, without limitation, the information set forth below under Item 1 regarding the description of our business and under Item 7 concerning 'Management's Discussion and Analysis of Financial Condition and Results of Operations,' identifies additional important factors that could cause these differences. We do not undertake to publicly update or revise our forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied in this Report on Form 10-K will not be realized. All subsequent written and oral forward-looking statements attributable to us or persons acting for or on our behalf are expressly qualified in their entirety by this section.

ITEM 1. BUSINESS.

OVERVIEW. Datascope Corp. is a diversified medical device company that develops, manufactures and markets proprietary products for clinical health care markets in interventional cardiology and radiology, cardiovascular and vascular surgery, anesthesiology, emergency medicine and critical care. We have four product lines that are aggregated into two reportable segments, Cardiac Assist / Monitoring Products and Interventional Products / Vascular Grafts. Operating data for each segment for the last three fiscal years is set forth in footnote 10 to the Consolidated Financial Statements. Our products are distributed worldwide by direct sales employees and independent distributors. Originally organized as a New York corporation in 1964, we reincorporated in Delaware in 1989.

AVAILABLE INFORMATION. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, amendments to those reports and other information is available on our website at www.datascope.com.

We have adopted a written Corporate Business Conduct Policy (including Code of Ethics) that applies to all Datascope employees. The Business Conduct Policy is posted on our website under the 'Corporate Governance' caption. We intend to disclose any amendments to, or waivers from, the Business Conduct Policy on our website. In addition, the Company's audit committee charter, compensation committee charter and nominations and corporate governance committee charter is also posted on the Company's website. A copy of any of these documents is available, free of charge, upon written request sent to Datascope Corp., 14 Philips Parkway, Montvale, New Jersey 07645, Attention:

Secretary.

Information included on the Company's website is not deemed to be incorporated into this Annual Report on Form 10-K.

GLOSSARY. WE HAVE PREPARED THE GLOSSARY BELOW TO HELP YOU UNDERSTAND OUR

BUSINESS.

Angioplasty is the reconstruction of blood vessels, usually damaged by atherosclerosis. If the arteries in question are in the heart, a coronary bypass operation may be recommended. However, the nonsurgical method of balloon angioplasty is often employed, especially when only one vessel is blocked.

Balloon Angioplasty, also known as percutaneous transluminal coronary angioplasty (PTCA), is a nonsurgical method of clearing coronary and other arteries blocked by atherosclerotic plaque, fibrous and fatty deposits on the walls of arteries. A catheter with a balloon-like tip is threaded up from the arm or groin through the artery until it reaches the blocked area. The balloon is then inflated, flattening the plaque and increasing the diameter of the blood vessel opening. The arterial passage is thus widened or dilated. Balloon angioplasty has evolved to include direct coronary stenting in greater than 70% of angioplasty procedures to prevent recoil or abrupt closure of the artery post dilatation.

Hemostasis is the stopping of bleeding, either by physiological properties of coagulation and vasoconstriction or by surgical or mechanical means.

Manual Compression is the stopping of bleeding by physical pressure placed specifically on a venous or arterial access site. With relation to Datascope's interventional products, manual compression is typically applied to the femoral artery.

Mechanical Thrombectomy is the process of removing clots within arteriovenous (AV) grafts or AV fistulas on chronic hemodialysis patients who are typically being treated for end stage renal disease.

Vascular Access is the means of entering the vasculature percutaneously in order to place a variety of catheters. Vascular Access can be either venous or arterial in nature and can occur at various points of the body. The most typical vascular access points are femoral (groin), subclavian (upper chest), internal and external jugular (neck), brachial and radial (arm).

MAJOR PRODUCT LINES. Our four major product lines are Patient Monitoring, Cardiac Assist, Interventional Products (formerly Collagen Products) and InterVascular (Vascular Grafts). The following table shows the percentage of sales by major product line as a percentage of total sales for the last three years:

JUNE 30,

Below is a more detailed description of our major product lines:

PATIENT MONITORING. We manufacture and market a broad line of physiological monitors and monitoring systems designed to provide for patient safety and management of patient care. Our monitoring solutions were developed for the demands of today's health care environment and can be integrated with our complete central station and telemetry system. They range from automated blood pressure monitoring devices to intensive care unit monitoring systems. They are used in operating rooms, emergency departments, critical care units, post-anesthesia units and recovery rooms, intensive care units and labor and delivery rooms. As part of our operating room business, we offer the Anestar(TM) Anesthesia Delivery System, a unique integrated breathing system designed for use with our Gas Module SE(TM) and our Passport 2(R) and Spectrum(TM) monitors.

Our line of patient monitoring products and their significant features are as follows.

PATIENT MONITORS

PASSPORT 2

o Portable, bedside monitor with color or monochrome display and 6 traces

o Optional View 12(TM) ECG Analysis module provides continuous 12-lead ECG interpretation with ST and arrhythmia analysis

o Built-in power supply, with Sealed Lead Acid or Lithium Ion battery option

o Fold-away bed rail hook, battery and lightweight design ensure convenient portability

o Specialized graph trend of heart rate, respiration and pulse oximetry for neonatal applications

o Oridion Microstream(R)1 CO2 with unique FilterLines(R)1 that adapt to any patient for easy CO2 monitoring

o Optional dual-trace, integrated recorder

o Masimo SET(R)2 or Nellcor(R)3 Oxismart(R)3 pulse oximetry

o Telemetry or hardwire communications to our central stations

o Anesthetic gas analysis through the Gas Module SE

SPECTRUM

o Powerful, portable bedside monitor built for performance and function

o Large, bright 12.1' high-resolution color display with up to 8 traces

o Specialized graph trend of heart rate, respiration and pulse oximetry for neonatal applications

o Built-in power supply with Sealed Lead Acid battery option

o Advanced functions for acute care areas, including advanced arrhythmia analysis, up to 4 invasive pressures, cardiac output with hemodynamic calculations, pulmonary artery wedge pressure and drug calculations

o Optional View 12 ECG Analysis module provides continuous 12-lead ECG interpretation with ST and arrhythmia analysis

o Available standard with Masimo SET pulse oximetry or with optional Nellcor Oxismart pulse oximetry

o Communicates with our central stations via telemetry or direct connections

o Anesthetic gas analysis with automatic 5-agent ID with the Gas Module SE

o Oridion Microstream technology ensures fast CO2 results with lightweight FilterLines

TRIO(TM)

o Portable, lightweight, compact monitor

o Ergonomically designed fold-away handle with built-in bed rail hook

o 8.4' high resolution color display with 4 traces

o Standard parameters include 3 or 5-lead ECG, NIBP, SpO2, respiration and temperature

o Full graphic and list trends of all monitored parameters with event markers

o Built-in power supply with Sealed Lead Acid or Lithium Ion battery option

o Masimo SET or OxiMax(R)3 pulse oximetry

o Optional two-trace, integral recorder

ACCUTORR PLUS(R)

o First non-invasive blood pressure monitor with an integrated patient database that automatically records up to 100 patient measurements

o Measures pulse oximetry (or blood oxygen saturation), temperature and heart rate

o Optional recorder module

o Optional Masimo SET or OxiMax pulse oximetry

o Long life lithium ion battery technology for up to 8 hours run time

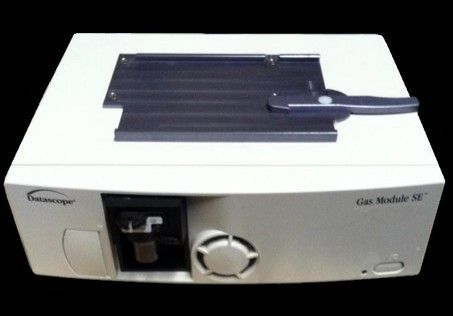

GAS MODULE SE

o Anesthetic gas measurement subsystem

o Monitors CO2, oxygen, nitrous oxide and all 5 inhalated anesthetic gases

o Interfaces with the controls and displays of the Passport 2 monitor for use in the growing out-patient surgery market

o Interfaces with the controls and displays of the Spectrum or Passport 2 monitors for use in main hospital operating rooms

2 Masimo SET is a registered trademark of Masimo Corporation.

3 Nellcor, Oxismart and OxiMax are registered trademarks of Nellcor Puritan Bennett Inc.

CENTRAL STATIONS

PANORAMA(TM) PATIENT MONITORING NETWORK

The Panorama Central Station, formally introduced on July 28, 2004, is Datascope's new platform for centralized monitoring of vital signs information. The Panorama Patient Monitoring Network is an integrated family of patient monitoring products that will enable hospitals to seamlessly share information on all patients via one network. The network will continue to evolve with the planned addition of remote viewing stations, a paging interface, hospital information systems interface and support for additional Datascope bedside monitors.

The significant features of the Panorama are:

o Central Station displays up to 12 patients on a single display or 16 patients on a single central station

o Bi-directional communication enables bedside alarm tracking between the bedside monitors and central station.

o Utilizes a single antenna infrastructure to support instrument and ambulatory telemetry in the protected Wireless Medical Telemetry Service medical band

o Supports hardwired and wireless monitoring on the same central station

o Stores all monitored parameters including continuous 12-lead ECG data

o Includes a new ambulatory telepack with integrated remote printing, nurse call and attendant preset buttons

o Includes new arrhythmia analysis package for central station and bedside monitors

PATIENTNET(R)4

o Telemetry system is Wireless Medical Telemetry Service compliant, operating on a dedicated hospital telemetry bandwidth in the 608-614 MHz range

o Can support both instrument and ambulatory patient telemetry

o Compatible with our Spectrum and Passport monitors

o Patient information may be exported to hospital and clinical information systems

o Employs access point technology which reduces the number of antenna required in older systems

o SiteLink(R)4 option allows caregivers to view and interact with patient information from many miles away

ANESTHESIA DELIVERY SYSTEMS

ANESTAR

o An advanced anesthesia delivery system

o Easy to use touch screen display

o IntelliVent(TM) ventilator offers volume and pressure ventilation for adults and pediatrics

o A unique integrated heated breathing system (EZ-Flow(TM)) eliminates potential for leaks, condensation and rainout, as well as warms patient gases to reduce potential risks to the patient

o Fresh gas decoupling ensures constant tidal volume delivery for easier maintenance of the system

o Automatic compliance compensation enhances the accuracy of the ventilator by compensating for any potential leaks

o Compatible with Passport 2, Spectrum, Trio and Gas Module SE

ANESTAR S

o Integrates the advanced functions of the Anestar platform into a smaller, more cost-effective package

o Smaller footprint and ergonomic design

o Same comprehensive safety features as the Anestar

o LCD touch screen display

o Low flow capabilities reduce the cost of ownership

o Compatible with Passport 2, Spectrum, Trio and Gas Module SE

SIGNIFICANT DEVELOPMENTS

In the last few years, we have expanded our line of patient monitoring products and achieved the following regulatory and marketing milestones:

o Panorama telemetry products distribution began in the first quarter of fiscal 2005

o Panorama Central Stations distribution began in the fourth quarter of fiscal 2004

o Trio received FDA 510(k) clearance in February 2004

o Anestar S anesthesia delivery system distribution began in September 2003

o OxiMax, Nellcor's newest patented SpO2 technology, was introduced in high-end Accutorr Plus models in the third quarter of fiscal 2004

o Cardiac output, calculations and pulmonary artery wedge pressure addition to Spectrum received FDA 510(k) clearance in September 2003

o Spectrum United States and international distribution began in the third quarter of fiscal 2003

o Trio began international distribution in the third quarter of fiscal 2003

o View 12 ECG Analysis Module for the Passport 2 began United States distribution in the first quarter of 2003

o View 12 ECG Analysis Module received FDA 510(k) clearance to market in September 2002

o Anestar anesthesia delivery system began distribution in January 2002

o Accutorr Plus product with the Lithium Ion battery began distribution in the first quarter of fiscal 2001

o Passport 2 began international distribution in the first quarter and United States distribution in the third quarter of fiscal 2000

o Passport 2 received FDA 510(k) clearance in January 2000

Markets, Sales and Competition. Our patient monitors are used in hospital operating rooms, emergency rooms, critical care units, post-anesthesia care units and recovery rooms, intensive care units and labor and delivery rooms. The Passport 2 provides a portable and cost effective monitoring solution for a wide range of departments, from emergency rooms and post-anesthesia care units to operating rooms and intensive care units. The Spectrum builds on the Passport 2's portability and ease of use with added features that make it a robust monitoring solution for higher acuity departments such as intensive care units, operating rooms and coronary care units. The Trio is targeted towards markets such as subacute care facilities, surgery centers, GI/ Endoscopy and general patient areas. The Panorama central station and telemetry network strengthens our product offerings across departments with innovative and unique features such as wireless bed-to-bed communications and storage of 12-lead ECG data. Lastly, with the addition of our Anestar and Anestar S anesthesia delivery systems, we offer a complete operating room solution that brings advanced features and functionality to outpatient surgery centers and operating rooms with space constraints.

A number of companies, some of which are substantially larger than us, manufacture and market products that compete with our patient monitoring and anesthesia delivery system products. Our major competitors in patient monitoring are Philips Medical, GE Healthcare, Spacelabs Medical, Nihon Kohden and Welch Allyn Medical Products. Our major anesthesia delivery system competitors are GE Healthcare through their Datex-Ohmeda unit and Draeger Medical.

CARDIAC ASSIST. We are a leader and pioneer in intra-aortic balloon (IAB) counterpulsation therapy and products including IAB pumps and catheters. Counterpulsation therapy is used to support and stabilize heart function. This therapy increases the heart's output and the supply of oxygen-rich blood to the heart's coronary arteries while reducing the heart muscle's workload and its oxygen demand.

The intra-aortic balloon system is used for the treatment of high-risk cardiac conditions resulting from ischemic heart disease and heart failure. Patients experiencing acute coronary syndromes such as acute myocardial infarction, cardiogenic shock and unstable angina may require IAB therapy to support and stabilize their cardiac status. IAB therapy is also used for high- risk patients who require revascularization procedures such as percutaneous coronary interventions or coronary artery bypass procedures including both on- pump and off-pump techniques. These products and therapy may be used before or during coronary artery bypass grafting or percutaneous coronary interventions for hemodynamic support.

We produce a line of disposable intra-aortic balloon catheters that serve as the pumping device within the patient's aorta. We introduced the first balloon catheter capable of percutaneous insertion. This innovation

eliminated the need for surgical insertion. As a result, the market for cardiac assist products expanded from open-heart surgery to interventional cardiology. We continue to advance our cardiac assist technology and to introduce new products.

Our line of cardiac assist products includes intra-aortic balloon pumps and intra-aortic balloon catheters.

INTRA-AORTIC BALLOON PUMPS (IABPS)

In August 2003, we launched our newest pump, the CS100(TM). The CS100 with IntelliSync(TM), a new proprietary software program, represents a major technological leap in the field of intra-aortic balloon counterpulsation. This new pump matches intelligence, automation and speed of delivery in a sophisticated algorithm that will adapt automatically to changing conditions. The result is continuous, consistent support for the patient.

We manufacture and market the following IABPs:

CS100

o IntelliSync software with smarter algorithms for greater patient support

o Automated trigger selection for easier and continuous patient support

o Automatic 'Beat to Beat' timing adjustments based on the patient's physiologic landmarks

o Faster pneumatics to support the most challenging arrhythmic patients

SYSTEM 98XT

o CardioSync(R) 2 software with improved algorithms to provide enhanced counterpulsation therapy

o Faster pneumatics

o Further reduction in required user intervention

SYSTEM 98

o Larger display

o Better automation

o Features make balloon pumping therapy simpler to administer and faster to initiate

SIGNIFICANT DEVELOPMENTS

In the last few years, we have expanded our product line of intra-aortic balloon pumps and achieved the following regulatory and marketing milestones:

o CS100 United States and European market introduction in August 2003

o System 98XT United States and European market introduction in December 2000

o System 98 approval to distribute in Japan received in March 1999

o System 98 United States and European Union distribution began in 1998

INTRA-AORTIC BALLOON CATHETERS

We manufacture a broad line of disposable intra-aortic balloon catheters for use with intra-aortic balloon pumps in support of counterpulsation therapy.

LINEAR(TM) 7.5 FR.

In June 2004, we launched our Linear 7.5 Fr. intra-aortic balloon catheter. Linear 7.5 Fr., with our new Durathane balloon material and improved 7.5 French ('Fr.') introducer sheath, offers easier insertion, improved abrasion and fatigue properties and, we believe, provides an improved solution for smaller adults, women, diabetics and patients with peripheral vascular disease.

In June 2004, we introduced the first and only needle-free securement device for IAB catheters, the StatLock(R), which secures the IAB catheter to the patient without the danger of accidental needlesticks or suture wound complications.

FIDELITY(TM)

In February 2002, we launched our Fidelity intra-aortic balloon catheter. We believe that Fidelity provides superior performance to all other 8 Fr. catheters in the market. Fidelity also offers the largest central

lumen (0.030') for consistent, clear arterial waveforms which results in better delivery of counterpulsation therapy for the patient and easier patient management for the healthcare provider. A new polymer design enables Fidelity to insert easily and navigate tortuous anatomies. Once inserted, physicians have the longest insertable length available on the market to ensure optimal balloon placement. Fidelity is available in 25cc, 34cc and 40cc balloon volumes.

In addition, we manufacture a complete line of intra-aortic balloon catheters to accommodate counterpulsation therapy in both the adult and pediatric population. We also manufacture catheters for pediatric patients in the 2.5cc, 5cc, 7cc, 12cc and 20cc volumes. Our 9.5 Fr. intra-aortic balloon catheters are available in 25cc, 34cc and 40cc volumes. A 50cc volume is also available for patients who are taller than 6 feet.

Clinical Support. We provide the following clinical and educational services to our customers:

o Telemedicine via our PC-IABP products which offers remote pump monitoring, allowing the healthcare provider continuous access and instantaneous troubleshooting from highly trained technicians

o 24 hour, 7 days a week clinical support

o On-site training and education for all personnel involved with patient care; over 30,000 clinicians are trained by our clinical staff annually

o Comprehensive educational materials for hospital staff, patient and family

o Consultative services to help hospitals maximize the goals of counterpulsation therapy within the hospital network

o The Benchmark(R) Registry--a comprehensive registry database to assist hospitals worldwide in tracking and comparing outcomes of counterpulsation therapy administered to their patients. This enables our customers to demonstrate and measure the clinical benefits of the therapy. We believe that we are the only supplier offering a comprehensive, centralized repository of global IABP information

Markets, Sales and Competition. Our cardiac assist products are sold primarily to major hospitals with open-heart surgery and balloon angioplasty facilities and community hospitals with cardiac catheterization laboratories. Our cardiac assist products have been sold, to a growing degree, to the broader range of community hospitals, where counterpulsation therapy is used for temporary support to the patient's heart prior to transport to a major hospital center where definitive procedures, such as balloon angioplasty or open-heart surgery, can be conducted. Our main competitor for cardiac assist products is Arrow International, Inc.

INTERVENTIONAL PRODUCTS (FORMERLY COLLAGEN PRODUCTS). Our primary products are used to seal arterial puncture wounds after angiography and other interventional procedures relying upon access to the body through the femoral artery. We participate in three distinct vascular sealing market segments primarily used in cardiology: collagen based products, suture based products and manual compression assist products. In addition, we have begun to develop a portfolio of products for Interventional Radiology. The new Interventional Products (IP) division name reflects our objective to broaden the division's product portfolio to include new products for interventional cardiology and interventional radiology. Our first product available for interventional radiology is a mechanical thrombectomy device used to clear blood clots from blocked dialysis access sites of hemodialysis patients.

Our line of interventional products is discussed below:

VASCULAR SEALING PRODUCTS

We design, manufacture and market the following vascular sealing products:

collagen based products, suture based products and manual compression assist products.

COLLAGEN BASED PRODUCTS

Our VasoSeal(R) and Elite(TM) brand vascular sealing products assure fast and reliable arterial hemostasis after common percutaneous cardiology and radiology procedures, such as balloon angioplasty, arterial stenting and diagnostic angiography.

We manufacture and market vascular sealing devices under four brand names, VasoSeal(R) VHD, VasoSeal ES(R), VasoSeal Low Profile and Elite. These products rapidly seal femoral arterial punctures. Unlike many other vascular sealing products, VasoSeal works extravascularly, meaning that the product works by sealing the femoral artery on the outside of the artery. With VasoSeal, doctors have an effective alternative to the many competitive sealing products that produce sealing by placing (and leaving behind) permanent foreign objects, such as sutures inside patient arteries. VasoSeal vascular sealing devices provide for reduced time to hemostasis of the arterial puncture wound, reduced time to patient ambulation and discharge following certain percutaneous procedures, cost savings to the hospital and increased patient satisfaction versus manual methods of arterial hemostasis.

VASOSEAL VHD

We manufacture and market the VasoSeal VHD extravascular sealing device, the first device of its kind to be approved in the United States. Prior to the introduction of VasoSeal VHD in 1995, the only way to seal femoral arterial puncture wounds was to apply significant pressure by hand over the arterial puncture site and to wait for the blood in the tract to clot naturally. This arterial sealing process is called 'manual compression.' Manual compression can take 20 minutes or more to accomplish even in the best of circumstances. But sometimes, if a patient has been administered anti-clotting drugs prior to their percutaneous procedure, the patient has to wait many minutes, sometimes even hours, for the effect of the anti-clotting drugs used during their procedure to diminish before manual compression can be successfully administered on their puncture site.

The concept behind the VasoSeal device is simple. The VasoSeal VHD comes with a measuring device that tells the doctor the depth of a patient's artery from the skin surface. The doctor then uses the VasoSeal VHD to deploy a soft collagen plug directly over the puncture site on the outside of the artery. VasoSeal VHD produces hemostasis in two ways. First, the collagen plug effects a mechanical barrier stopping blood from flowing up the puncture tract. Second, the collagen in the device's plug interacts with the patient's own blood to stimulate the formation of fibrin, simulating the body's own, natural clotting process. By design, and unlike other vascular sealing devices on the market, VasoSeal VHD does not leave a foreign object inside of a patient's artery after deployment. In addition, unlike manual compression, VasoSeal VHD permits the immediate removal of the procedural sheath used in many cardiology and radiology procedures, even when anti-clotting drugs have been administered to a patient.

VASOSEAL ES

The VasoSeal ES device, introduced in Europe in 1998 and in the United States in 1999, retains the proprietary, extravascular technology of our original VasoSeal VHD. However, VasoSeal ES features a 'one-size-fits-all' (5 to 8 Fr.) design that eliminates the physician's need to measure skin-to- artery distance and the hospital's need to stock multiple sizes of the device. These features are made possible by VasoSeal ES's unique locator technology that is capable of easily and precisely locating the arterial puncture site below the skin's surface.

VasoSeal ES is the first vascular sealing device to have been found safe and effective in patients with peripheral vascular disease. As many as 30% of the total patient population undergoing percutaneous cardiology and radiology procedures have peripheral vascular disease.

VASOSEAL LOW PROFILE

VasoSeal Low Profile is a smaller version of VasoSeal and is available in five kit sizes. This device meets the needs of hospitals who have been increasingly using smaller diameter access sheaths in their percutaneous procedures to minimize vascular trauma. VasoSeal Low Profile is approved for sealing 5 Fr. or smaller puncture sites.

ELITE

Elite is the newest VasoSeal product utilizing a unique, proprietary sponge collagen technology to produce hemostasis. Elite's new sponge collagen is deployed into a patient's tissue tract, just above the femoral artery, in a compressed form. Upon exposure to blood, the compressed sponge collagen plug expands in seconds to produce an effective mechanical blockade above the femoral artery.

Elite uses the same one-size-fits-all location system as VasoSeal ES. However, the body design of Elite is substantially different than that of VasoSeal ES. The Elite body design was developed after years of studying the ergonomics of the earlier generation VasoSeal devices and the different ways physicians deploy these devices. From this research, we developed the unique and effective body design for Elite. The new Elite body was designed specifically to minimize variations in physician deployment methods, variations that could compromise the precise placement of VasoSeal's collagen plug. The new body design of the Elite maximizes the device's potential for producing rapid, secure and consistent mechanical hemostasis.

Elite provides physicians with the same rapid and reliable mechanical closure capabilities of the competitive closure devices that leave foreign objects behind in patient arteries. Yet, like the rest of the VasoSeal line, Elite achieves its goals while protecting and preserving the common femoral artery from unnecessary intrusions and left-behind artifacts.

Elite is designed to serve as the only vascular sealing device a hospital should need to stock. It can be utilized for both diagnostic and interventional procedures. It can be used with a broad variety of 5 to 8 Fr. sheaths. Like VasoSeal ES, Elite has been proven safe and effective in diverse patient populations, including those with peripheral vascular disease.

ADVANTAGES OF VASOSEAL

VasoSeal devices offer the following advantages:

o Reduced time to ambulation: Certain patients can be ambulated much faster than is possible with conventional manual compression methods. This claim provides the following benefits to the user and hospital.

1. Significant potential savings for hospitals because patients can be moved relatively quickly after their percutaneous catheterization procedures to lower cost areas in the hospital.

2. Allows the majority of diagnostic angiography patients to be ambulated safely within one hour after the procedure, compared with 4 to 6 hours under standard clinical practice, which involves manual compression for vascular closure.

3. Lowers the use of human and material resources in the hospital which results in improved patient management and cost minimization.

o Provides increased comfort and satisfaction for patients. Many patients receiving diagnostic or interventional procedures in hospitals are in poor health, are elderly and/or have other medical problems which make it difficult for them to remain motionless or to lie flat for long periods of time. The pressure devices (i.e. sand bags and manual compression), still predominately used by hospitals to produce vascular sealing, cause further discomfort to these patients.

o Has been proven to be safe and effective in patients diagnosed with peripheral vascular disease. As a result, VasoSeal can be used on many more patients than other competitive devices.

o Approved for deployment by healthcare professionals other than physicians (i.e. nurses and technicians), providing a more cost-effective use of hospital resources.

o Reduced time to discharge: Early discharge of certain patients provides the facility with efficiencies throughout the patient care-path. Fewer patient recovery hours equates to better bed utilization, more efficient staffing and fewer overall resources required, providing another cost saving component of the VasoSeal product use.

SIGNIFICANT DEVELOPMENTS

In the last few years, we have expanded our line of vascular sealing products and achieved the following regulatory and marketing milestones:

United States, FDA Approvals, Major Products:

o Elite PMA Supplement approved in August 2002

o VasoSeal Low Profile PMA Supplement approved in June 2002

o VasoSeal ES PMA Supplement approved in December 1998

o VasoSeal VHD granted Pre-Market Approval (PMA) in September 1995 United States, FDA Additional VasoSeal Approvals:

o Modified Hold Technique deployment method in March 2002

o Reduced time to discharge claim in diagnostic angiography patients in September 2001

o Use in patients with peripheral vascular disease demonstrated as safe and effective in August 1999

o Deployment by nurses and technologists in September 1997

o Use after stent implantation in April 1997

o Use in radiology procedures in December 1996

o Early ambulation claim in diagnostic angiography and delayed sheath pull interventional patients in August 1996 CE Mark Approvals:

o Elite approved to market in Europe in 2002

o VasoSeal Low Profile approved to market in Europe in 2002

o VasoSeal ES approved to market in Europe in 1998

o VasoSeal VHD approved to market in Europe in 1997

o Prior to 1997, European approvals for VasoSeal VHD had been granted in individual countries, specifically Italy, Spain and the Netherlands Japan:

o VasoSeal VHD cleared for reimbursement for certain interventional procedures by the Ministry of Health in January 2000

o VasoSeal VHD approved to market in 1994 Canada:

o VasoSeal VHD Medical Device License granted for prior approvals 2000

o VasoSeal ES Amendment to License approved 2000

Markets, Sales and Competition. Our VasoSeal line of products is sold to both interventional cardiology and radiology labs, both in hospitals and in independent diagnostic facilities. The current market size for vascular closure devices is approximately $430 million annually. A number of companies, some of which are substantially larger than us, manufacture and market products that compete with the VasoSeal VHD, VasoSeal Low Profile, VasoSeal ES and Elite devices. Our competitors are Abbott Laboratories (Perclose, StarClose and Chito-Seal patch), St. Jude Medical (Angio-Seal), Vascular Solutions, Inc. (Duett and D-Stat Dry patch), Sutura, Inc. (Super Stitch), Marine Polymer Technologies (Syvek Patch) and Scion Technologies (Clo-Sur Pad, marketed by Medtronic, Inc.).

MANUAL COMPRESSION ASSIST PRODUCT

SAFEGUARD(TM)

Safeguard is a manual compression assist product to aid in the treatment for hemostasis, providing the customer with multiple device options. It is typically utilized on the femoral arterial site but may also be used in brachial, radial and subclavian vessels as well on cardiac, dialysis and critical care patients. Safeguard affixes to the site with an adhesive backing and offers hands-free pressure through inflation of a bulb with a syringe. Safeguard was introduced in the second quarter of fiscal 2004.

ADVANTAGES OF SAFEGUARD

o Adjustable, hands-free pressure which guards the site with consistent pressure

o Maintains pressure during patient recovery and maximizes valuable staff resources

o Innovative design makes Safeguard easy to apply and simple to use

o Provides direct visualization of the site and allows for immediate pressure adjustments

o Enhanced patient comfort, because Safeguard is flexible and conformable, does not restrict patient mobility and no ancillary equipment or straps are required

SIGNIFICANT DEVELOPMENTS

Safeguard has achieved the following milestones:

o Been determined to be a Class I, exempt product within the FDA regulations; and

o Received the CE Mark in October 2003.

Markets, Sales and Competition. We estimate the market for manual compression assist devices to be approximately $60-80 million annually. Safeguard competes with other manually assisted compression devices such as FemStop (Radi) and patches. A number of companies, some of which are larger than us,

manufacture and market competitive products. Among them are Abbott Laboratories, St. Jude Medical, Medtronic, Vascular Solutions and Marine Polymer Technologies.

SUTURE BASED PRODUCT

In May 2004, Datascope acquired certain assets and technology from X-Site Medical, LLC (X-Site), a privately held company located in Blue Bell, Pennsylvania. The acquired assets include all technology related to X-Site's lead product, a suture-based vascular closure device for achieving hemostasis after coronary catheterization procedures. The product is scheduled to be released in fiscal 2005.

In a controlled clinical study of approximately 260 patients, the X-Site device was shown to be easy to use and demonstrated an excellent safety profile. The device has received FDA clearance and will increase our presence in the vascular closure market. The addition of the X-Site product represents a logical expansion in the area of hemostasis management and reflects our strategy of providing new and innovative products in this field.

Markets, Sales and Competition. The X-Site product competes in the vascular sealing closure device market estimated at approximately $430 million annually, with suture-mediated devices representing over $100 million in sales. To date, Abbott Laboratories, which markets the Perclose product, is the only other suture-mediated device in this segment. The X-Site product will be manufactured and marketed by the Interventional Products direct sales force, which currently sells other vascular closure devices.

INTERVENTIONAL RADIOLOGY

PROLUMEN(TM)

Our first entry in the interventional radiology market was a dialysis access product, the ProLumen, launched in March 2004. ProLumen is a mechanical thrombectomy device designed to break up clots in arteriovenous grafts in patients who are on chronic hemodialysis. The product is placed through a sheath and advanced through the graft. The ProLumen received FDA 510(k) clearance in February 2004.

ADVANTAGES OF PROLUMEN

Because of its S-wave wire design, we believe that ProLumen provides superior mechanical thrombectomy and effectively competes with both wall and non-wall contact devices. The S-wave wire also provides excellent maneuverability around tight bends in the graft. ProLumen comes with both the wire and motor drive unit preassembled. Further, there is no capital equipment investment required as the device is a single use product.

Markets, Sales and Competition. The market for mechanical thrombectomy devices is approximately $30-40 million annually. A larger segment continues to use thrombolytic agents (known as 'lyse and wait') prior to mechanical intervention. We cannot predict how quickly the market will shift from these agents to mechanical intervention. ProLumen is primarily marketed to interventional radiologists and vascular surgeons. A number of companies manufacture and market products that compete with ProLumen. Our main competitors are Arrow International and Possis Medical, Inc.

Clinical Education and Support - Interventional Products. We offer health care providers the following services in connection with our interventional products:

o On-site training and education of all personnel involved with product deployment and post-deployment patient care to assure successful device outcome

o 24 hour, 7 days a week clinical support

o Comprehensive educational materials and programs for staff

o Patient information guides to educate the patient on appropriate post- care regimens

o Consultative services to help facilities identify and maximize the goals and objectives of vascular sealing

INTERVASCULAR (VASCULAR GRAFTS). Our InterVascular Inc. subsidiary designs, manufactures and distributes a proprietary line of knitted and woven polyester vascular grafts and patches for reconstructive vascular and cardiovascular surgery. Vascular grafts are used to replace and bypass diseased arteries.

InterVascular is actively broadening its line of vascular surgery products. Our vascular graft products and their significant features are as follows.

INTERGARD(R) KNITTED PRODUCTS

Collagen coated graft for use in most vascular applications for reconstruction of abdominal and peripheral arteries.

INTERGARD(R) WOVEN PRODUCTS

Designed primarily for use in thoracic aortic repair and open-heart surgery.

INTERGARD(R) SILVER

o World's first anti-microbial vascular graft

o Designed to prevent post-operative infection of the graft, which occurs in 2% to 5% of cases, by using the broad spectrum, anti-infective properties of silver, which is released from the surface of the graft into surrounding tissues following implantation

o Prosthetic graft infections are associated with high morbidity, including amputation and high mortality

o Vascular graft infection typically lengthens the hospital stay of a patient by up to 50 days, which results in an increase in treatment cost of approximately $85,000

INTERGARD(R) ULTRATHIN

o The thinnest knitted polyester collagen coated graft on the market giving it exceptional handling and suturing

o Designed specifically for use in the replacement of peripheral arteries

INTERGARD(R) HEPARIN

o A heparin bonded collagen coated graft for replacement and bypass of peripheral arteries

o Occlusion of a peripheral graft following surgery is the most frequent cause of graft failure

o InterGard Heparin is designed to address the issue of occlusion and improve long term patency of the graft by allowing the antithrombogenic and antiproliferative properties of unfractionated heparin to be available locally on the graft surface for several weeks following implantation

o Three year results of a clinical trial have shown that use of InterGard Heparin has 25% better patency and 65% fewer amputations compared to ePTFE, a synthetic material frequently used for peripheral artery bypass or repair

HEMACAROTID PATCHES

o Collagen coated patches used for repair of carotid and peripheral arteries

o HemaCarotid patches also manufactured in the UltraThin configuration

o HemaCarotid and HemaPatches also manufactured in Silver and Heparin configurations

SIGNIFICANT DEVELOPMENTS

In the last few years, we have expanded our line of vascular graft products and achieved the following regulatory and marketing milestones:

o HemaPatch Silver was introduced in Europe in March 2004

o HemaCarotid Patch Heparin was introduced in Europe in March 2004

o InterGard Heparin UltraThin graft was introduced in the United States in fiscal 2003

o Aortic Arch and HemaBridge (specialty grafts for thoracic aorta repair and replacement) received FDA clearance in March 2002

o InterGard Heparin received FDA clearance in January 2001

o InterGard UltraThin was introduced in the United States during fiscal 1999

o InterGard Silver received CE Mark April 1999, for commercial sale throughout European Union

o InterGard Woven Products were introduced in the United States during fiscal 1999

o InterGard was approved in both the United States and Japan in fiscal 1998

Markets, Sales and Competition. Our vascular graft products are sold to vascular and cardiothoracic surgeons. A number of companies, some of which are substantially larger than us, manufacture and market products that compete with our vascular graft products. Our major competitors are Boston Scientific, Vascutek, W.L. Gore and Impra, a subsidiary of C.R. Bard, Inc.

LIFE SCIENCE RESEARCH PRODUCTS. In 1998, we entered the life science research market by forming a new subsidiary, Genisphere Inc. Genisphere has developed reagents based on a new, proprietary class of DNA molecules known as 3DNA(R), or Three Dimensional Nucleic Acid. A reagent is a biologically or chemically active substance. Genisphere's reagents are used to detect and measure other biological substances. Our 3DNA-based reagents have been shown to provide greater sensitivity in nucleic acid and protein detection assays than it is possible to achieve using conventional detection methods.

Based on our current market entry strategy, our life science research products will be designed primarily for use in newly developed kinds of detection assays. In these new markets, adoption of new technologies, such as 3DNA technology, occurs much faster and potential customers are more highly concentrated and easier to reach, when compared to the mature blot market, which was our initial target market. Our first products for these new markets were detection kits designed to improve the reliability and sensitivity of microarray experiments. We have also recently begun selling proprietary products that are designed to increase the size of nucleic acid samples.

A number of companies, some of which are substantially larger than us, manufacture and market products that compete with our life science research products. Our major competitors include Amersham Biosciences, PerkinElmer Life Sciences Inc. and Agilent Technologies.

RESEARCH AND DEVELOPMENT

We invested approximately $32.5 million in 2004, $29.0 million in 2003 and $25.7 million in 2002 on research and development of new products and the improvement of our existing products. We have established relationships with several teaching hospitals for the purpose of clinically evaluating our new products. We also have consulting arrangements with physicians and scientists in the areas of research, product development and clinical evaluation.

OUR MARKETING AND SALES ORGANIZATION

Our products are sold through direct sales representatives in the United States and a combination of direct sales representatives and independent distributors in international markets. Our worldwide direct sales organization employs approximately 400 people and consists of sales representatives, sales managers, clinical education specialists and sales support personnel. We have a worldwide clinical education staff, most of whom are critical care and catheterization lab nurses. They conduct seminars and provide in-service training to nurses and physicians on a continuing basis. Our sales are broadly based and no customer accounted for more than 10% of our total sales in fiscal years 2004, 2003 and 2002. Our primary customers include physicians, hospitals and other medical institutions.

We provide service and maintenance to purchasers of our products under warranty. After the warranty expires, we provide service and maintenance on a contract basis. We employ service representatives in the United States and Europe and maintain service facilities in the United States, the Netherlands, France, Germany, Belgium and the United Kingdom. We conduct regional service seminars throughout the United States for our customers and their biomedical engineers and service technicians.

International sales as a percentage of our total sales were 35% in 2004, 32% in 2003 and 30% in 2002. We have subsidiaries in the United Kingdom, France, Germany, Italy, Belgium and the Netherlands. Because a portion of our international sales are made in foreign currencies, we bear the risk of adverse changes in exchange rates for such sales. Please see Notes 1, 2 and 10 to the Consolidated Financial Statements for additional information with respect to our international operations and foreign currency exposures.

COMPETITION

We believe that customers, primarily hospitals and other medical institutions, choose among competing products on the basis of product performance, features, price and service. In general, we believe price has become an important factor in hospital purchasing decisions because of pressure to cut costs. These pressures on hospitals result from federal and state regulations that limit reimbursement for services provided to Medicare and Medicaid patients. There are also cost containment pressures on healthcare systems outside the

U.S., particularly in certain European countries. Many companies, some of which are substantially larger than us, are engaged in manufacturing competing products.

SEASONALITY

Typically, our net sales are lower in the first and second quarters and higher in the third and fourth quarters. Lower net sales in the first quarter result from patient tendencies to defer, if possible, hospital procedures during the summer months and from the seasonality of the United States and European markets, where summer vacation schedules normally result in fewer hospital procedures. Lower net sales in the second quarter result from holidays in the United States and other markets and patient tendencies to defer, if possible, hospital procedures during these holiday seasons. Independent distributors may randomly place large orders that can distort the net sales pattern just described. In addition, new product introductions and regulatory approvals can impact the typical sales patterns.

SUPPLIERS

Our products are made of components which we manufacture or which are usually available from existing and alternate sources of supply. Some of our products are manufactured through agreements with unaffiliated companies. We purchase certain components from single or preferred sources of supply. Our use of single or preferred sources of supply increases our exposure to price increases and production delays. In addition, certain of our suppliers have been contemplating, and in a few cases have begun, reducing or eliminating sales of their products to medical device manufacturers like us. We are not able to predict whether or not additional suppliers will withhold their products from medical device manufacturers, including us.

PATENTS

Datascope Anestar Service Manuals

We hold a number of United States and foreign patents. In addition, we also have filed a number of patent applications that are currently pending. We do not believe the expiration or invalidity of any of our patents would have a material adverse effect on our business as currently conducted.

EMPLOYEES

At the end of fiscal 2004, we had approximately 1,320 employees worldwide. We believe our relationship with our employees is good.

ORDERS BACKLOG

At June 30, 2004, we had a total backlog of unshipped customer orders of $26.4 million, primarily for patient monitoring products. Substantially all of the backlog will be delivered in fiscal 2005. The total backlog at June 30, 2003 was $20.7 million.

REGULATION

Our medical devices are subject to regulation by the FDA. In some cases, they are also subject to regulation by state and foreign governments. The Medical Device Amendment of 1976 and the Safe Medical Device Act of 1990, which are amendments to the Federal Food, Drug and Cosmetics Act of 1938, require manufacturers of medical devices to comply with certain controls that regulate the composition, labeling, testing, manufacturing and distribution of medical devices. FDA regulations known as 'Current Good Manufacturing Practices for Medical Devices' provide standards for the design, manufacture, packaging, labeling, storage, installation and service of medical devices. Our manufacturing and assembling facilities are subject to routine FDA inspections. The FDA can also conduct investigations and evaluations of our products at its own initiative or in response to customer complaints or reports of malfunctions. The FDA also has the authority to require manufacturers to recall or correct marketed products which it believes do not comply with the requirements of these laws.

Under the Act, all medical devices are classified as Class I, Class II or Class III devices. In addition to the above requirements, Class II devices must comply with pre-market notification, or 510(k), regulations and

with performance standards or special controls established by the FDA. Subject to certain exceptions, a Class III device must receive pre-market approval from the FDA before it can be commercially distributed in the United States. Our principal products are designated as Class II and Class III devices.

We also receive inquiries from the FDA and other agencies. Sometimes, we may disagree with positions of members of the staffs of those agencies. To date, the resolutions of such disagreements with the staffs of the FDA and other agencies have not resulted in material cost to us.

We are also subject to certain federal, state and local environmental regulations. The cost of complying with these regulations has not been, and we do not expect them to be, material to our operations.

We are also affected by laws and regulations concerning the reimbursement of our customers' costs incurred in purchasing our medical devices and products. Healthcare providers that purchase our medical devices and products generally rely on third-party payors, including the Centers for Medicare and Medicaid Services (CMS) which administers Medicaid and Medicare, and other types of insurance programs, to reimburse all or part of the cost of such devices. The laws and regulations in this area are constantly changing, and we are unable to predict whether, and the extent to which, we may be affected in the future by legislative or regulatory developments relating to the reimbursement of our medical devices and products.

On August 1, 2000, CMS established a product-specific reimbursement system for devices used in the hospital outpatient setting that provided for reimbursement for VasoSeal ES and, as of October 1, 2000, for VasoSeal VHD. Effective April 1, 2001, CMS replaced the product-specific reimbursement system with a new system that provided reimbursement for specific types of devices, including vascular closure devices. VasoSeal VHD and ES devices were eligible for reimbursement under this new system as well. Effective April 1, 2002, CMS significantly reduced the reimbursement rate for all vascular closure devices. These reimbursements ended as of January 1, 2003.

HEALTH CARE REFORM

Our management cannot predict at this time what impact, if any, the adoption by the United States Congress of health care reform legislation will have on our business.

ITEM 2. PROPERTIES.

The following table contains information concerning our significant real property that we own or lease:

We also lease office space in England, France, Italy, Belgium and Germany. We believe that our facilities and equipment are in good working condition and are adequate for our needs.

ITEM 3. LEGAL PROCEEDINGS.

We are subject to litigation in the ordinary course of our business. We believe we have meritorious defenses in all material pending lawsuits. We also believe that we maintain adequate insurance against any potential liability for product liability litigation. We receive comments and recommendations with respect to our products from the staff of the FDA and from other agencies on an on-going basis. We may or may not agree with these comments and recommendations. However, we are not a party to any formal regulatory administrative proceedings.

In December 2000, an action was filed in New York Supreme Court against us and our board of directors entitled David B. Shaev v. Lawrence Saper, Alan B. Abramson, David Altschiller, Joseph Grayzel, M.D., George Heller, Arno Nash and Datascope Corp. The complaint alleges, inter alia, common law claims for breach of the duty of loyalty and breach of fiduciary duty for approving allegedly excessive compensation to defendant Saper. By agreement, the time to respond to this complaint has been extended. The action is pending.

Datascope Anestar Plus Service Manual

In August 2001, an action was filed in United States District Court for the District of New Jersey against us and our board of directors entitled David B. Shaev v. Lawrence Saper, Alan B. Abramson, David Altschiller, Joseph Grayzel, M.D., George Heller, Arno Nash and Datascope Corp. The Complaint alleges, inter alia, that our October 27, 2000 proxy statement contained materially false and misleading statements concerning, among other things, the deductibility for federal income tax purposes of Mr. Saper's bonus compensation, that it omitted material facts regarding the bonuses payable and the number of persons eligible under the Management Incentive Plan, and that it was coercive insofar as it stated that we might grant Mr. Saper a bonus if the Plan were not approved by the stockholders. The Complaint also alleges that the defendant directors breached their duties of good faith and loyalty and were negligent in connection with these matters, and by approving allegedly excessive payments to Mr. Saper. On April 1, 2002, the District

Datascope Anestar Service Manual User

Court granted our motion to dismiss the action, holding that the proxy statement did not contain materially false or misleading statements. The Court declined to exercise its supplemental jurisdiction over the remaining state law claims and dismissed those claims without prejudice. Plaintiff appealed from the order of dismissal to the Third Circuit Court of Appeals. In a decision filed on February 21, 2003, the Third Circuit vacated the District Court's order of dismissal and remanded the case for further proceedings. In so doing, the Third Circuit noted that for purposes of the appeal it was required to accept as true all of the plaintiff's allegations and held that the plaintiff stated a cause of action on the grounds, among other things, that the proxy statement failed to accurately disclose certain matters relating to management incentive plans under which Mr. Saper received compensation. The Third Circuit also found that dismissal of the complaint for failure by plaintiff to make demand upon the Board of Directors prior to bringing a derivative action was not appropriate at this preliminary stage of the case. Following remand, the parties have participated in mediation procedures and have begun discovery.

On January 28, 2003, Sanmina-SCI, one of our suppliers, filed a complaint in the Superior Court of California, County of Santa Clara, claiming that we are obligated to purchase excess inventory of Sanmina-SCI. Sanmina-SCI seeks damages of $1.2 million, plus material markup, carrying costs and interest. In response, we filed an answer denying the allegations of the complaint and counterclaimed for damages we suffered in the amount of $2.3 million for Sanmina-SCI's breach of its obligation to us. We believe we have meritorious defenses and a meritorious counterclaim and intend to proceed vigorously in this matter. Mediation was attempted in April 2004 without success and now discovery is being conducted.

The Public Prosecutor's Office in Darmstadt, Germany is conducting an investigation of current and former employees of one of our German subsidiaries. The investigation concerns marketing practices under which benefits were provided to customers of the subsidiary. We are cooperating with the investigation. The German subsidiary has annual revenues of under $5 million. We cannot predict at this time what the results of the investigation may be or whether it could have a material adverse effect on us or our business.

On December 2, 2003, a former Datascope employee, Michael Barile, filed a complaint in the Superior Court of New Jersey, Law Division, Bergen County, against Datascope Corp. and various John Does seeking, inter alia, indemnification from the Company of approximately $1 million in legal fees and expenses he allegedly incurred in defending a criminal action brought against him by the United States Attorney's Office for the District of Maryland, as well as additional damages Mr. Barile alleges he suffered as a result of such prosecution. In response, the Company has filed an answer denying the allegations of the complaint and has brought counterclaims against Mr. Barile seeking damages resulting from Mr. Barile's improper conduct as an employee of Datascope. The Company believes it has meritorious counterclaims and meritorious defenses to Mr. Barile's claims and intends to defend and prosecute this action vigorously. Mr. Barile has replied to the Company's counterclaims by denying them. Mediation was held on April 28, 2004 and the parties agreed to exchange a limited amount of discovery material before another mediation, to discuss settlement, is scheduled.

Datascope Anestar Service Manual Transmission

On July 20, 2004, a former Datascope employee, Harry Gugnani, filed a complaint in the Superior Court of New Jersey, Law Division, Bergen County, against Datascope Corp. and various John Does seeking damages for emotional distress, damage to reputation and malicious prosecution related to a criminal action brought against him by the United States Attorney's Office for the District of Maryland. The Company will file an answer denying the allegations of the complaint. The Company believes it has meritorious defenses to Mr. Gugnani's claims and intends to defend this action vigorously.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

No matters were submitted to a vote of security holders in the fourth quarter of fiscal year 2004.

ITEM 4A. EXECUTIVE OFFICERS OF THE COMPANY.

Datascope Anestar Service Manual Pdf

The following table sets forth the names, ages, positions and offices of our executive officers:

Comments are closed.